1099 hourly rate to salary calculator

Our salary calculator has been updated with the latest tax rates. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

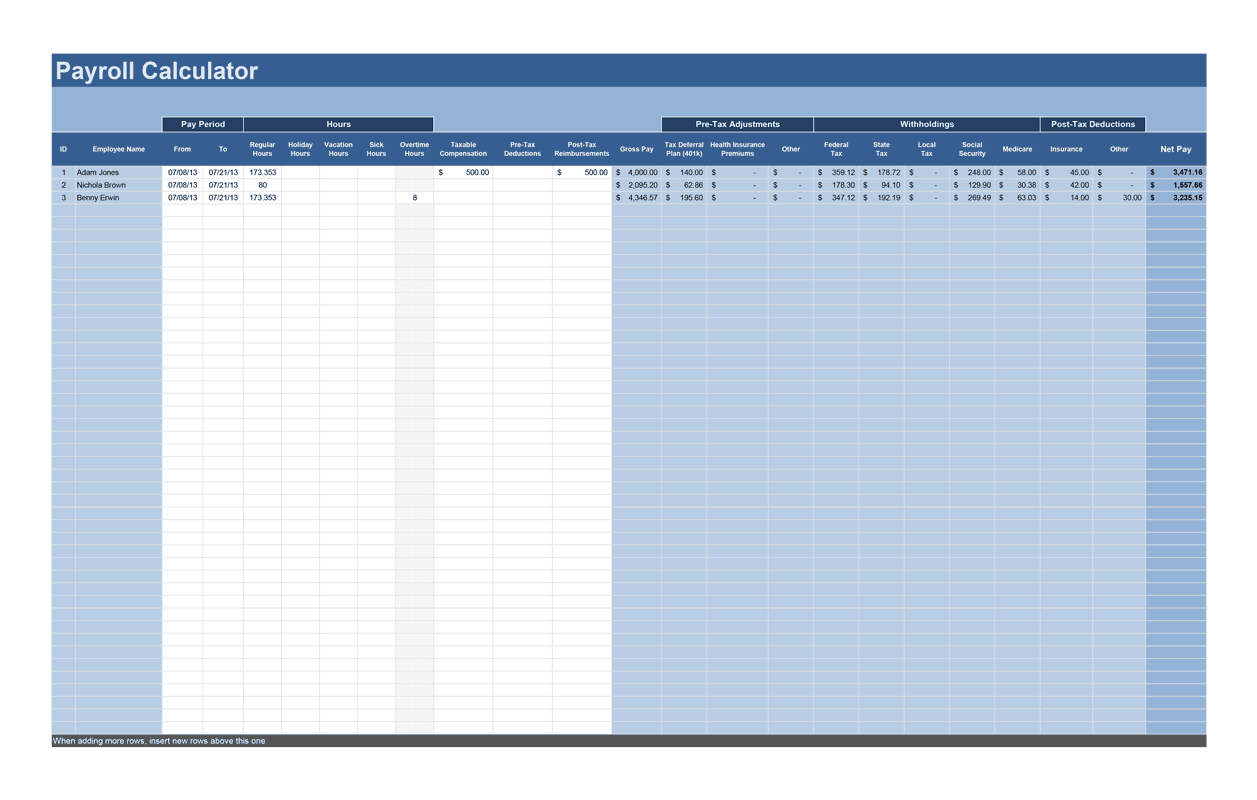

Payroll Calculator Free Employee Payroll Template For Excel

We have put together a calculator you can use here to calculate your personal hourly rate.

. Form 1099-MISC is used to report other types of income while a Form W-2 is used to report salary or hourly wages. Use this calculator to view the numbers side by side and compare your take home income. Payroll for QuickBooks Desktop.

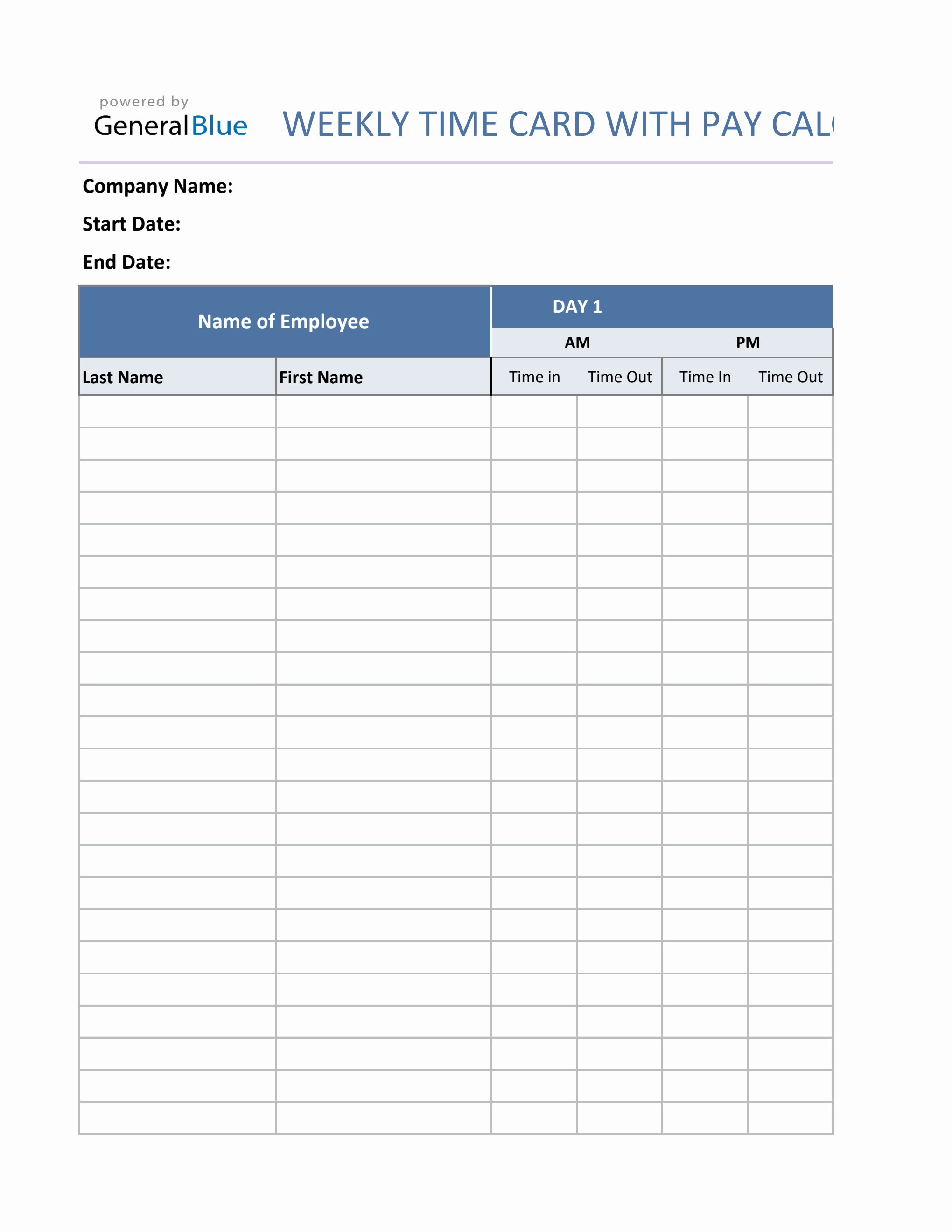

Manage 1099 Invoicing 2 Manage 1099 payments 2 Manage Direct Deposits 1 Mapertunity 1. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Overtime pay is often more than the regular hourly rate too.

How The Consulting Rate Calculator Works. There are several types of 1099 forms but the most common is 1099-MISC which is used to report miscellaneous income. 13-0000 Business and Financial Operations.

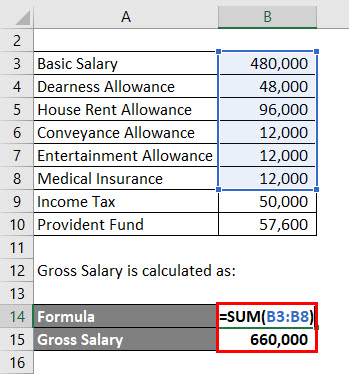

Or if you need to convert a salary into an hourly wage you can divide the salary by 2080. CPI Inflation Calculator. A new hire with little experience might be paid the minimum amount in that salary range as their basic salary.

Community and Social Service Specialists All Other. Salary wage or similar compensation Payment of cash tips or equivalent. The salary range is based on market rates for that work as well as the experience and skills of the employee.

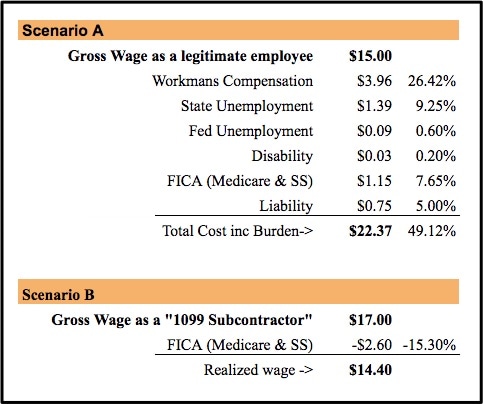

Your Daily Fully Loaded Cost rate. Stub creator provides best calculator to calculate in hand salary for hourly and salaried employees on its free salary paycheck calculator tool. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765.

Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by using a reliable payroll service. Your contact information on the site you agree that Biz2Credit may. The employees salary must be at least 684 per week which is more than you would hourly employees to work 40 hours at minimum wage.

Adjusting- 91hr08 114hr on 1099. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. Find your 1099 hourly rate.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. Many jobs have a salary rangea minimum and maximum amount that a company is willing to pay to fill a position. If you have a fixed salary the calculation is pre-tax annual salary divided by 40.

W-2 hourly rate difference is rarely so simple when an employees annual salary and benefits package are also factors. If you are an hourly employee and get paid varying amounts on a weekly every other week or twice a month schedule the calculator works from your after-tax take-home pay by multiplying your monthly take-home by 035 35. You will often be asked or offered this number.

Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Enter the workers details in the payroll calculator and select the hourly pay rate option.

This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. Annual wages have been calculated by multiplying the hourly mean wage by a year-round full-time hours. Thats why most business owners are comfortable with paying a higher rate for freelancers than W2 employees.

That way you can compare the salary for each role to each other role. Contractors or other 1099 workers do not count toward the payroll of your business. Links to OEWS estimates for other areas and states.

When youre a 1099 employee that means you basically work for yourself. Major Occupational Groups Note--clicking a link will scroll the page to the occupational group. You can generally lower your rate for longer term contracts as your utilization rate will increase.

In the US there are basically two types of employment. This is a great exercise to come up with a target hourly rate that you can use to start negotiations with a client. This is simply how much it cost to pay you your annual salary on an hourly basis.

Links to OEWS estimates for other areas and states. W-2 Pay Difference Calculator for Salary and Benefits. Links to OEWS estimates for other areas and states.

From the point of view of business owners they save a lot of money on these benefits and taxes when hiring 1099 contractors for short-term projects. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Links to OEWS estimates for other areas and states.

Then enter the number of hours worked. You cant adjust your costs when revenue fluctuates such as. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Employees can calculate their net pay or take home pay by entering pay period YTD hourly and annual salary rate. Switch to Massachusetts salary calculator.

2017-2020 Lifetime Technology Inc. Payment for vacation parental family medical or sick leave. Links to OEWS estimates for other areas and states.

This counts even if they have only worked part of a full hour. Links to OEWS estimates for other areas and states. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file.

Injury and Illness Calculator. A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half So if your employee earns 20 an hour their overtime rate would be 30 per hour. 1099 workers can apply for PPP independently.

1099 MISC Form. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Of course knowing the 1099 vs.

Should I Agree To Be Paid As An Independent Contractor

Weekly Timecard With Pay Calculation For Contractors In Excel

How To Calculate Your 1099 Hourly Rate No Matter What You Do

Payroll Calculator Free Employee Payroll Template For Excel

Salary To Hourly Salary Converter Salary Hour Calculators

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Templates Professional Templates

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Tax Payment Calculator Online 52 Off Www Wtashows Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Payroll Calculator Free Employee Payroll Template For Excel

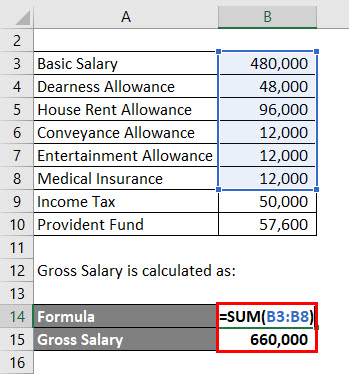

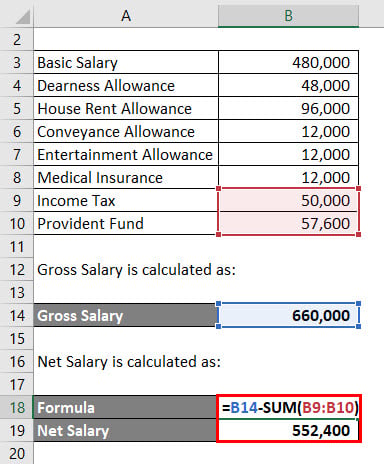

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary